Popular Gifts

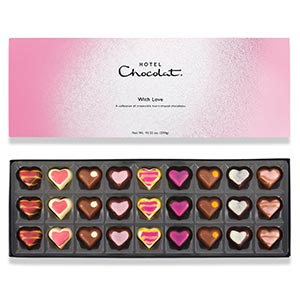

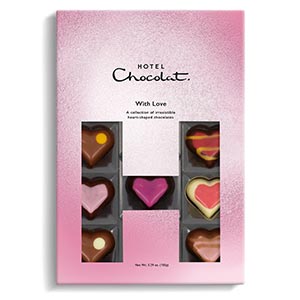

Luxury Chocolate Gifts

Seeking a luxury chocolate gift? Our in-house chocolatiers blend expertise with artistry (and plenty of high-cacao chocolate, of course) to create our portfolio of imaginative chocolate gifts. Indulge in our unique collection of Vegan chocolates, Truffles and our irresistible array of Liqueur chocolates.